|

Getting your Trinity Audio player ready...

|

Gurugram’s real estate market is evolving fast. With infrastructure upgrades, booming connectivity, and smart township developments, certain micro-markets (sectors) in Gurugram are emerging as very attractive realty hotspots in 2025. Here are some of the key areas to watch – and why.

Key Gurugram Real Estate Hotspots to Watch in 2025

1. Dwarka Expressway Corridor

-

This is perhaps the most talked-about micro-market. The Dwarka Expressway has boosted connectivity significantly, making the adjacent sectors very attractive. Trade Brains+2geosquare+2

-

Sectors such as 113, 111, 103 are especially hot. The Times of India

-

According to Evantis Realty, Sector 113 is becoming a luxury enclave, thanks to its metro access, proximity to Delhi, and high-end residential projects. EVANTIS REALTY

-

Commercial real estate is also growing strongly in this corridor. Aarize points out that the Upper Dwarka Expressway is turning into a “commercial magnet.” Aarize Group

-

Property values here have doubled in some places in recent years. geosquare+1

Why invest: Great long-term capital appreciation, good for both end-users and investors, and high demand.

2. New Gurugram (Sectors 79–95)

-

This area, sometimes called “New Gurugram,” is becoming a self-sufficient urban hub. According to AIPL, Sectors 79–92 are seeing rapid development. AIPL

-

JK Greens Capital highlights these sectors for their affordability + connectivity (via NH-48, Dwarka Expressway, and even the Haryana Metro). JK Greens Capitals

-

According to Gangarealty, New Gurugram is perfect for long-term investors: lower entry cost than core Gurugram, but strong future upside. Ganga Realty

Why invest: Good mix of mid-segment and luxury projects, upcoming infrastructure, and room for appreciation.

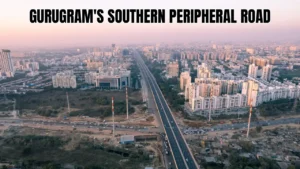

3. Southern Peripheral Road (SPR) Corridor

-

SPR is emerging as a major growth corridor. According to The Financial Express, there are huge residential + commercial projects coming up here. The Financial Express

-

JK Greens Capital also calls out SPR as a “blend of premium residential + commercial opportunities.” JK Greens Capitals

-

The connectivity advantage is strong: SPR links to Golf Course Road, Sohna Road, and more, making commutes easier. Ganga Realty

Why invest: Strategic location, rising infrastructure, and great for both residential homes and commercial investment.

4. Golf Course Extension Road (GCER)

-

This micro-market is already well-established and remains a luxury & high-appreciation zone. AIPL calls it a “premium edge” area. AIPL

-

According to TradeBrains, prices in GCER have surged, with multistorey apartments commanding very high rates. Trade Brains

-

GCER also has a stable rental demand because of the premium buyer base. AIPL

Why invest: High capital value, prestige, limited supply, and consistent demand.

5. Sohna / Sohna Road (South Gurugram)

-

According to Gangarealty, South Gurugram (especially along Sohna Road) is growing fast. Ganga Realty

-

With more integrated townships, residential complexes, and infrastructure, it’s no longer “just outskirts.” sloc.in

-

The Financial Express highlights sectors along Sohna Road as offering good ROI potential, with increasing social infrastructure. The Financial Express

Why invest: More affordable than premium Gurugram, but with huge growth potential; good for families and long-term buyers.

6. Sector 57 (Luxury / Builder Floor Segment)

-

According to Evantis Realty, Sector 57 is emerging as a luxury residential hub with builder-floors and high-quality developments. EVANTIS REALTY

-

Its proximity to Golf Course Extension Road and top schools makes it attractive for end-users. EVANTIS REALTY

Why invest: For premium but slightly less “ultra-luxury” buyers, good for long-term capital appreciation + lifestyle.

Risks & Things to Watch Out For

-

Over-supply risk: Rapid development means some sectors might see more inventory, which could affect price runs.

-

Regulatory & project delay risk: Infrastructure projects (metro, expressway) may face delays; always check project status.

-

Liquidity risk: Highly premium projects (like in GCER) may not sell as fast, especially in downturns.

-

Cost of upkeep: In luxury zones, maintenance + property tax may be high.

Final Thoughts: Where to Put Your Money in 2025

-

For long-term capital appreciation: Dwarka Expressway, New Gurugram (Sectors 79–95), SPR.

-

For luxury living / premium properties: Golf Course Extension Road, Sector 57.

-

For balanced investment (mid + high risk): Sohna Road / South Gurugram areas.

If I were advising an investor or a home-buyer in 2025, I’d definitely keep a close eye on New Gurugram + Dwarka Expressway — both offer a strong mix of growth, affordability, and infrastructure upside.

Comments